Great Elevator Pitches: 3 Other Opinions

Elevator Pitch Series Table of Contents:

- Introduction

- 3 Key Lessons

- What to Include

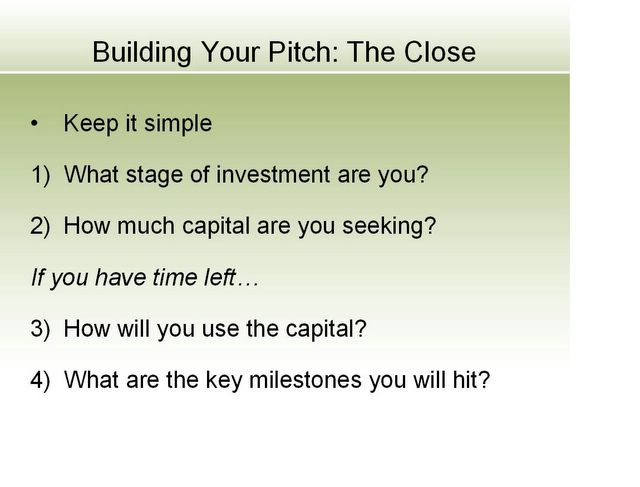

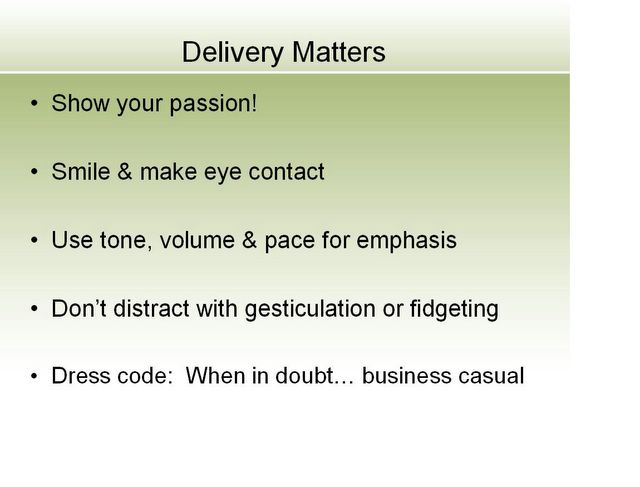

- Delivery Matters

- Screwing Up My Elevator Pitch

- SVASE Presentation Slides

- 3 Additional Opinions

An attempt to demystify the process of raising capital, democratize information and help entrepreneurs improve their businesses by avoiding the mistakes that I've already made... and occasionally include a personal post because Rich told me to.

Elevator Pitch Series Table of Contents:

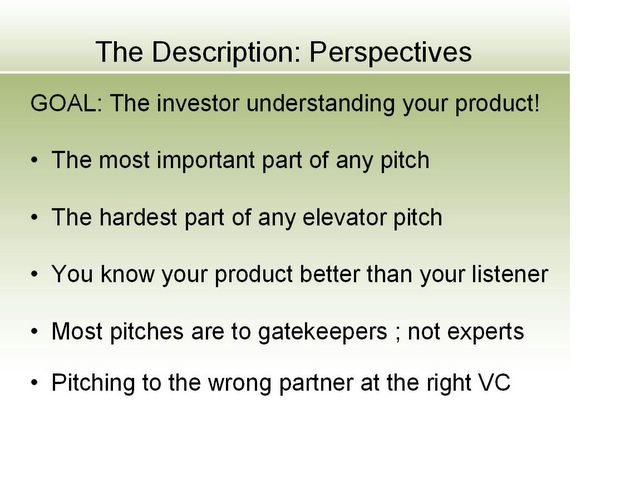

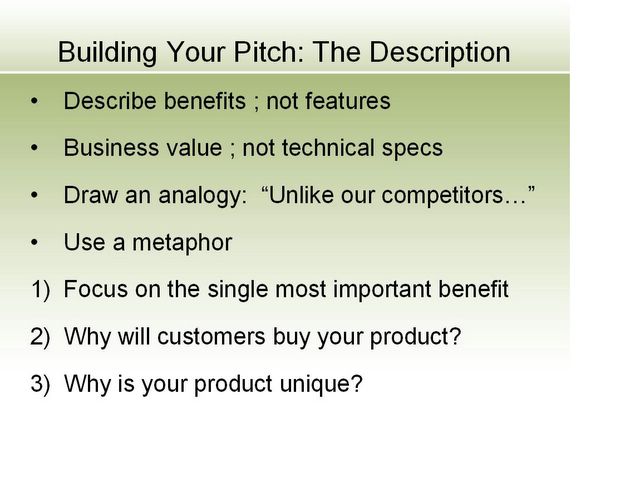

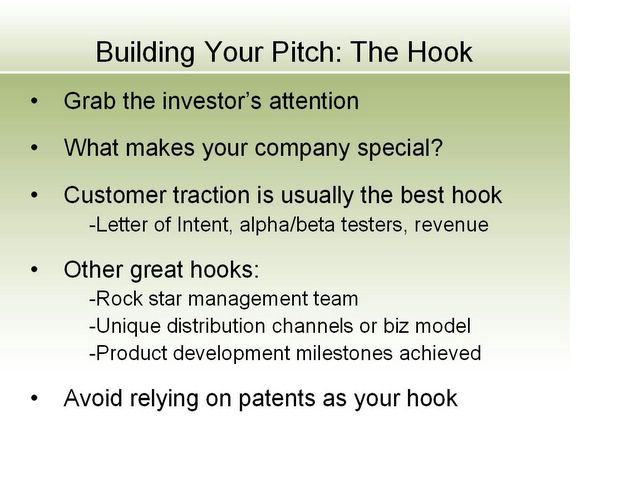

This is a list of slides that I wrote for a presentation which I moderated at SVASE's Silicon Valley North Startup University in February. The presentation slides below are based on earlier postings I wrot on elevator pitches that can be found here:

Peter Ireland has posted a list of Angel Groups recently published in Business 2.0 here. The Biz 2.0 list is definitely not comprehensive and I've added a few more California based groups that I'm aware of.

In regards to my posting on why VC's need grand slams, I'd like to point out two more interesting articles that help elucidate the process of VCs raising money.

"The baseline fee structure in the industry is a 2% management fee and a 20% share of any profits (known as the carry). The best firms get a 3% fee and a 30% carry. A few rare birds do even better than that. While some firms split the profits equally between the partners, most skew the GP split to favor the more senior (though not necessarily the most successful) partners."The article also makes two other points that I found very interesting. Given the relative size of hedge funds as compared to venture funds (many billions vs. hundreds of millions), hedge funds can divert relatively small percentages of their capital under management and instantly become major players. Mr. Burnham also suggests hedge funds may not even after profits from their venture investments but rather information that they can use to place smarter bets in the public markets where they invest the majority of their capital.

According to Tom Formeski Tivo constomers can get access to Tivo's source code because they are using GPL software. Cool, I hope this leads to lots new Tivo hacks.

"I had an interesting chat with a patent attorney from Philips, the huge

Dutch-based consumer electronics company. Philips has been using open-source

products within its products for many years. It uses Linux and other components

in its TVs and other consumer electronics gear which is often resold under oem

deals.

"We tell our partners that they have to offer the source code to their

customers, " he said. Because that is the stipulation in the open source

licensing agreement. So, if you purchase a product that contains Linux (e.g.

Tivo) you have to be offered the source code. But over a five year period, not

one customer has bothered to read the small print and make such a request."

The difference between a fundable and a lifestyle business is essentially how big and how fast a company can grow, but why do venture firms need such outlandish returns? Venture firms invest other people’s money and they need to return an appropriate premium for the risk they take. I’ve found looking at the structure of how a venture firm is run to be helpful in elucidating why VCs can’t invest in even the most successful lifestyle businesses.

The notion of raising venture capital is appealing to most entrepreneurs because it means millions of dollars and very smart people are validating and backing their businesses. However, very few businesses are actually fundable with venture capital. This is because most business really can't achieve the types of return necessary to make the venture capital firm's own business model work.

In the startup world businesses get divided into two categories: fundable and lifestyle. Fundable businesses have 3 key qualities:

1) Can create value of at least 10X (and preferably 15-20X) the venture money invested

2) Can lead to a liquidity event

3) Can do both 1 & 2 in 5-7 years

A lifestyle business is essentially anything that doesn't have all 3 of these characteristics. Common lifestyle businesses are restaurants, franchises, or any type of professional services/consulting businesses. Professional services businesses simply can't grow quickly enough because they are dependent on hiring new consultants to work on more projects and generate new revenue. Restaurants and franchises have growth problems because the logistics of creating and staffing new outlets doesn't scale quickly enough. Furthermore, exits in these businesses are less clear and generally don't command high valuations.

There are also many types of lifestyle businesses in technology. This is primarily because the market being served isn't large enough or the business is really based on a feature rather than a stand alone product, which in some respects is essentially the same thing. The reason why investors place so much emphasis on the size of the market is to determine how big the exit could be. Software to automate shrimp farming could be a category killer, but if that market is only worth $25 million it will be impossible to achieve a meaningful exit for the venture firm.

Features also aren't fundable. There are a lot great extensions to Firefox and Outlook, but while these "products" aren't necessarily created by Microsoft or the Mozilla Foundation, they are features rather than stand alone products. The growth of a feature business is totally dependent on the product they compliment. Furthermore, it's rare that features have deep enough IP to be protectable or valuable. For example, if a company produces a great new feature for Outlook that everyone has to have, how long would it take Microsoft to build on its own? M&A is fundamentally a question of build, borrow or buy. If the feature can be easily reproduced than the startups leverage to convince Microsoft to borrow (license) or buy (acquire) is greatly reduced and the valuation lowered.

Knowing what a meaningful exit for the firm is key to understanding whether or not the business will ultimately be considered fundable and should be a part of the due-diligence done by the entrepreneur prior to meeting with the VC. A $20-30 million exit won't be enough to move the needle of most venture funds, however, it may be meaningful to smaller funds. As a general rule the size of the addressable market for venture fundable businesses is $500 million and most VCs prefer billion dollar markets.

The good news is that lifestyle businesses can be very lucrative to entrepreneurs. In some cases, a $20-30 million lifestyle exit can better for the entrepreneur who creates a successful venture backed startup. For instance, owning 75% of a business sold for $20 million would net the entreprenuer $15 million. It would take an exit of at least $150 million from a venture backed business where the entrepreneur is unlikely to own more than 10% to create the same $15 million net. Also, there are many lucrative oportunities that produce great cash flow that simply don't have predictable enough liquidity events to entice venture firms.

Technology Ventures Corporation (TVC) is an startup's best friend. TVC provides startup consulting services, a recruiting service and monthly seminars focused on helping startups improve their businesses and raise capital. All of TVC's services are provided at no cost (and no equity either) to the entrepreneur. I have been a client of TVC for about 6 months now and I have nothing but positive things to say about the organization and Scott Gilbert who is the consultant that I have been working with.

Fred Greguras and Blake Stafford of Fenwick & West have written an interesting 4 page article on high tech startups raising early stage capital in the SF Bay Area. The article was written in 2004 but I just stumbled on to it today. I think that it is a good introduction to the subject and an interesting insight into the perspective of 2 of the top corporate attorneys working with startups in Silicon Valley. You can read the article here.

On the advice of John Koontz, I've applied for the Amazon Associate program to alleviate my free-rider guilt by choosing not to use AdSense in my blog. I am now advertising "The Art of the Start" because it is the best introduction to entrepreneurship that I have read. You can read the first chapter here.

My dislike of Google is totally irrational but it is to some extent driven by the arrogance emanating from Mountain View. The people working for that organization who got stock are so full of themselves and I just don't see the brilliance behind the company. Before anyone more technical than I explains how Google has the entire Internet stored in ram or that they were the first search engine to filter out the porn sites spamming their meta data let me remind you that the average web surfer doesn't know what meta data is. I trust that Google's algorithm is great but it doesn't provide noticeably different results than Yahoo, MSN or Ask to the average user, who like me, doesn't know what meta data is. Google's revenue is driven by the average web surfer using their portal and if there isn't any noticeable difference between them and their competition than their value must be in their brand. Google turned out to be a catchy name and their minimal/clean front page were points of differentiation that must have helped their page views grow but was this really marketing genius?

Elevator Pitch Series Table of Contents:

Elevator Pitch Series Table of Contents:

This morning I attended an event on CEO / board relations at Pillsbury Winthrop. The event had its highs and lows, but one comment from Teros CEO Bob Walters really stood out. He mentioned that when he was in the naval academy the phrase "I don't know" was banned from the dorms. If a cadet was ever asked a question to which they did not know the answer, the only appropriate response was "I'll find out." Teros was recently acquired by Citrix and in retrospect, its no wonder that Bob was so successful; if he didn't know the answer to something he went and found it out, which is the essence of entrepreneurship.

This is just a quick blog to post some thoughts on the pros and cons of blog advertising.

A nasty worm is currently spreading right now and is set to start deleting files on Friday (2/3). I don't normally like to provide advice on specific security threats, however, I believe that consequences of infection in this case are severe enough that it warrants the warning.

I just finished reading Geoffrey Moore's article on Google's strategy. Moore points out that in today's world anything that gets eyeballs is media and therefore it can be monetized through selling ads.

"Obviously this is true of digitized content in virtually any form. The interesting thought is that it is also true of products and services. Word processors, spreadsheets, presentation software, live updates, back-ups, auctions, VOIP, videos; if there is a human being in the room paying any attention at all, these are all forms of media."He also states that companies like Microsoft and SBC are in for trouble in the short run because google's advertising model allows them to give away the core products that they are trying to sell.

"Perhaps the most important implication of this strategy is that, in any competition with a product provider, say Microsoft, to pick a non-random example, or with a service provider, say SBC to pick another, Google can give away the very elements which their competitors are looking to monetize. In the past companies like Microsoft and SBC have been able to respond to the open systems challenges of competitive paradigms like Linux and the Internet by giving away the base product or service and selling customers on the upgrades. But Google can afford to give away the upgrades as well, at least for the time being. How do you compete with that?"This is all pretty standard stuff as far as I'm concerned. However, Moore does hint at a some type of rebalancing in the future that might not spell doom for traditional vendors selling ad-free products. I've been thinking about this idea myself. I love the advertising model of offering a great product or service (or product as a service) that attracts users and creates opportunities for very targeted advertising through some combination of the data collected during registration, the individual users usage and usage patterns across groups of users. But what industry can't be cannibalized through this type of shift? Is it possible to get to a point where there aren't enough commercial products available to advertise, or that their sales are hurt so badly by free alternatives that they can't advertise? I don't know where the point of equilibrium is and I suspect that we aren't close now, but I do believe that the flood gates are opening as the recent successes of advertising based web startups more entice more entrepreneurs look for ways to offer free services.